Idea Roundup #12

AT&T, and some interesting SEC Disclosures

Hope everyone’s had a great week! Keep an eye on your inbox for my latest deep dive this coming week. Also, I’m going to try out something slightly new here. I read a lot of SEC filings throughout the week, and while the vast majority of what I read is of little to no consequence, sometimes you find quite interesting stuff. So, I’ll be adding a section to the Idea Roundups dedicated to some of the more interesting filings of the week, which can lead to investment ideas on their own. As always, please see the disclosures at the bottom, and have a great weekend!

1. AT&T T 0.00%↑

In my experience, AT&T is a stock that pros love to have and retail loves to love. The company has a long and checkered history of making poor business and financial decisions, and the memory of those decisions has resulted in a stink that the professional community just can’t seem to get out of their noses.

I think, however, that it finally may have washed off.

After jettisoning the anchor of its media businesses, AT&T’s stock has quietly had itself a year, handily beating the S&P 500 SPY 0.00%↑ over the last twelve months, and leaving the stock knocking on the door of 10-year highs.

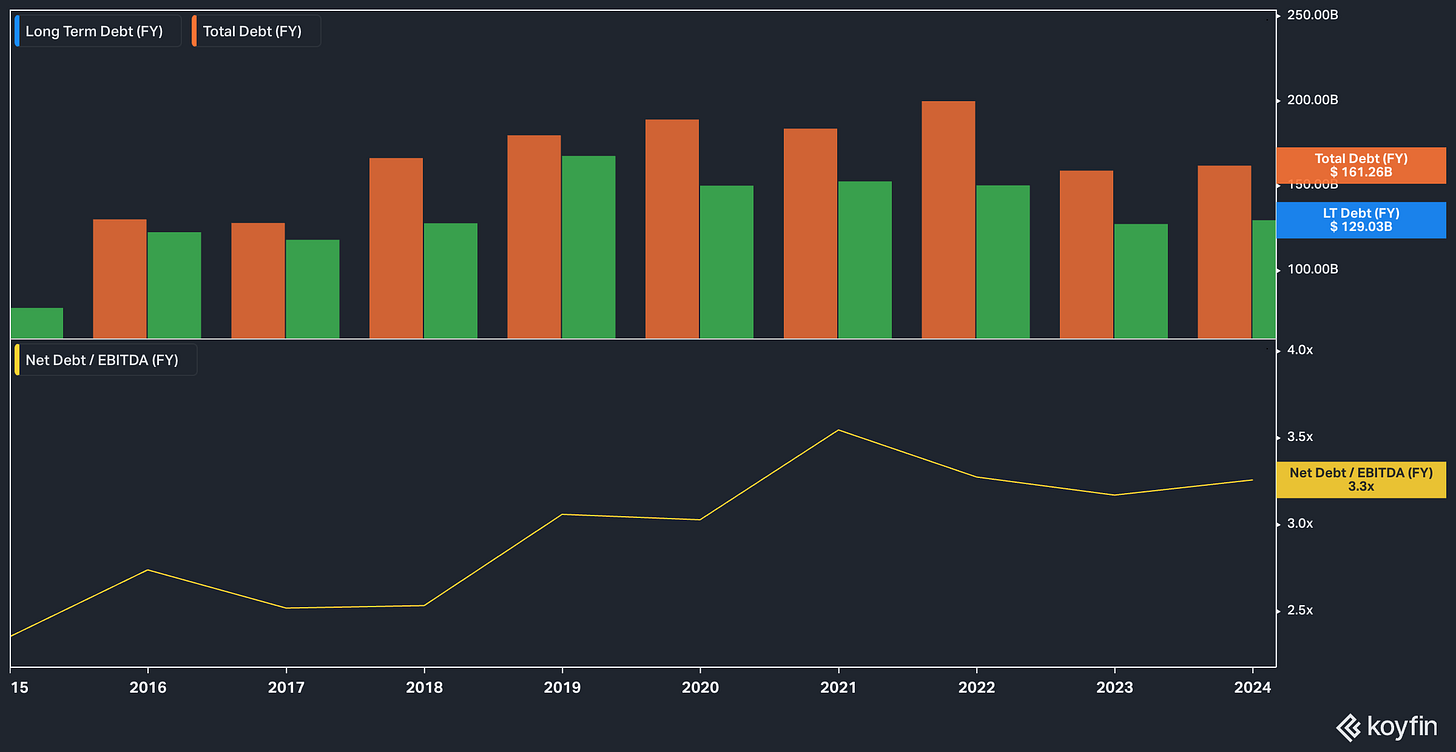

One of the biggest worries people had (or still have) about AT&T is the debt load, but management has been slowly paying down total debt.

Net debt to EBITDA is also not completely out of whack. As of the latest quarter, AT&T had a net debt / EBITDA of 2.8x compared with Verizon’s VZ 0.00%↑ 3.3x.

Is AT&T totally out of the woods? Tough to say. But the last twelve months have been promising.

AT&T T 0.00%↑ Take: Cautiously Bullish

2. Mobileye MBLY 0.00%↑

After a long stint of treading water, the market finally seemed to issue an opinion on Mobileye stock, which has dropped 55% in the last 3 years.

This decline isn’t exactly surprising, of course. Over the past three years analysts have consistently downplayed expectations across the board for the company.

Consider for a moment that in January 2023, analysts expected the company to generate roughly $11.4 billion in revenue looking out four years (FY 2027). That expectation has since dwindles down to $3.5 billion. Not good.

The stock took a bigger hit today when Mizuho hit it with a pretty substantial downgrade, lowering the price target from $30 to $13. $13! In a world where price target cuts of one or two dollars moves the needle, a $17 drop either says something about Mobileye’s prospects or Mizuho’s team covering the stock. You can take your pick on that one.

Mobileye MBLY 0.00%↑ Take: Bearish

3. Affirm Holdings, Inc AFRM 0.00%↑

Reading up on Affirm, to me, harkens back to a bygone era where interest rates were non-existent and companies burned cash like the Joker while investors cheered.

This whole arrangement was great for everyone—companies kept losing money, and stocks kept going up. Until, of course, they didn’t.

Affirm (and others like it) were something of a poster child for ZIRP era stock market excess, and rising interest rates laid the stock low, from over $150 a share to sub-$10.

Analysts, however, have suddenly turned positive on the stock, with Barron’s reporting that the company has received three upgrades over the last week.

Part of this has to do with the new deal the company signed with Apple and the anticipated business said deal will bring. It’s also important to note that the company still remains unprofitable, although I should note that the company edged closer to GAAP EPS profitability in this last quarter than it has in the last three years.

More than GAAP EPS profitability, the company still has yet to report even positive EBIT (though they beat expectations with a smaller than expected operating loss).

Sell-side analysts, ever the optimistic bunch, still generally believe the company will achieve profitability in the next FY. From my foxhole, however, it still seems premature to get excited about this company in a non-zero interest rate environment. If profitability does come, it will be interesting to see what valuation the market assigns. While I think it should be low and conservative, I don’t call the shots around here.

Affirm AFRM 0.00%↑ Take: Neutral to Bearish

What’s New In SEC Filings…

1. News Corporation NWS 0.00%↑

A few weeks back, Starboard Value announced it had taken a sizable stake in News Corporation—the company which owns a large swatch of financial media outlets including the WSJ, Barrons, and digital real estate assets such as REA Group. On October 10th, we finally got a taste of Starboard’s case for eliminating the company’s dual-share class structure, among other things with the filing of the DEFC14A. As usual with anything Starboard does, it’s quite good and interesting reading.

2. Warby Parker WRBY 0.00%↑

Last Friday (October 4th) at 5pm, Warby Parker filed an 8-K outlining the resignation of board member Gabrielle Sulzberger, effective October 18th. On the surface it looks pretty routine, but shareholders will probably be pretty interested in what else the form discloses—the board went ahead and reduced the size of the board from 10 to 9 directors and reclassified one director’s status—Theresa Briggs—from Class I to Class III, which was achieved by Ms. Briggs resigning, and then immediately being re-elected by the board with a new term ending at the 2027 annual shareholders meeting (her original term was slated to expire at the 2025 annual shareholders meeting).

The board did this under the guidelines set forth under the Amended and Restated Bylaws of the company, but… in my humble opinion, it’s not exactly a great look when the board extends a director’s term without shareholder input.

In Other News…

Tesla’s TSLA 0.00%↑ Robotaxi event was kind of a bust, and the stock is down a little more than 8% as of this writing. For more on that I highly encourage you to jump over to the always-excellent

for his coverage of the event. JPMorgan JPM 0.00%↑ and Wells Fargo WF 0.00%↑ beat expectations. McDonald’s MCD 0.00%↑ is rolling out a chicken Big Mac.Disclaimer: The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice, and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.