Idea Roundup #8: It's Good To Be 2nd Place

Today we take a look at Microsoft, Disney, and more!

Thanks for reading this week’s Idea Roundup, published each Thursday. As always, nothing here is investment advice. Be sure to read the disclaimer at the end—this is a work of opinion, not investment advice! Cheers—IR.

1. Microsoft (MSFT)

While it might not seem obvious, playing second fiddle in business can often be a good thing. While being top dog is always the goal, there’s a lot that comes with it in terms of public sentiment—Walmart (WMT) is a prime example of a company receiving a ton of public scorn while rival Target (TGT) went largely unscathed.

While it might be difficult to consider Microsoft second fiddle to anyone, the company has found itself subordinated more often than it would like to the products and services of other companies. CEO Satya Nadella, when testifying against Google last October, flatly said that “[t]he internet is really the “Google web”, which is a wild admission for the head of Microsoft to make.

At any rate, Google and Apple—leaders in their respective fields to which Microsoft comes in second—have long enjoyed public acclaim. That all seems to be coming to an end. Google has been gripped with issues and concerns that the company is falling behind on AI, among other things. Apple is now being sued as a monopoly by the DOJ.

So, in the end, perhaps it is better to play second fiddle?

From a shareholder’s perspective, it’s tough to complain. Microsoft remains a cash-generating juggernaut and provides multiple essential, sometimes behind-the-scenes services that are so ubiquitous that they resemble utilities (a bad word in tech).

At any rate, those with long memories will remember the days when Microsoft itself was in the crosshairs of the DOJ—shareholders (and management) can likely sleep well now that the pendulum has swung and that Microsoft’s competitors are now staring down the barrel.

2. Disney (DIS)

The future looks a lot like the past over at Disney now that Bob Iger has successfully fended off a corporate coup staged by Trian Partner’s Nelson Peltz. Yesterday the company’s annual meeting concluded with shareholders electing the company’s full 12-director slate.

I find this result surprising, but the more I think about it the less surprising it gets. Disney and its shareholders, after all, have a long and storied history of boardroom battles, and it’s not unreasonable for Disney shareholders to feel like Peltz’s proposals were changes for change’s sake, and that Iger’s proposals probably needed a little more runway before being judged accurately.

Disney shareholders, meanwhile, have got to be happy with the stock’s recent performance. Following the reinstatement of the dividend in November 2023, the stock has regained some of the ground it lost over the last few years.

What is most important now, though, despite all the endless twists and turns of the boardroom fight, is that it’s over. Disney’s current management can now operate under the pretext of a mandate from the shareholders.

For some interesting and insightful commentary on Disney and the background of its recent history, check out the article below (this is just one, there are many more) from

over at his Substack, Value Investing.3. Dollar General (DG)

Don’t look now, but Dollar General is staging a comeback. After dealing with a high-profile management change and some pretty blistering pieces from the media, the value retailer has surged ~50% since cratering last October.

This isn’t very surprising—despite labor issues, Dollar General’s value proposition remains robust, and in many of the locales in which it operates it’s essentially the only game in town.

But is Dollar General stock still a value? Well, the picture gets a little murky when you look at forward valuation metrics.

Looking back over the last 10 years, Dollar General’s stock today is edging into the upper quartile range for its forward P/E and EV/EBITDA valuations, which, in this writer’s humble opinion, should cause investors to tread with caution.

For what it is worth, analysts seem to believe that the stock is fairly valued at today’s levels:

According to Koyfin data, of the 31 analysts who rate Dollar General, 17 currently rate it a hold.

4. Tesla (TSLA)

At the risk of being made to look foolish by the legions of Tesla fans who have propped up this stock on dubious fundamentals for so long, it appears as though the dam may be cracking for Tesla stock.

The company made big waves (and not good ones) when it announced on April 2nd that it delivered almost 50,000 vehicles less than analysts expected.

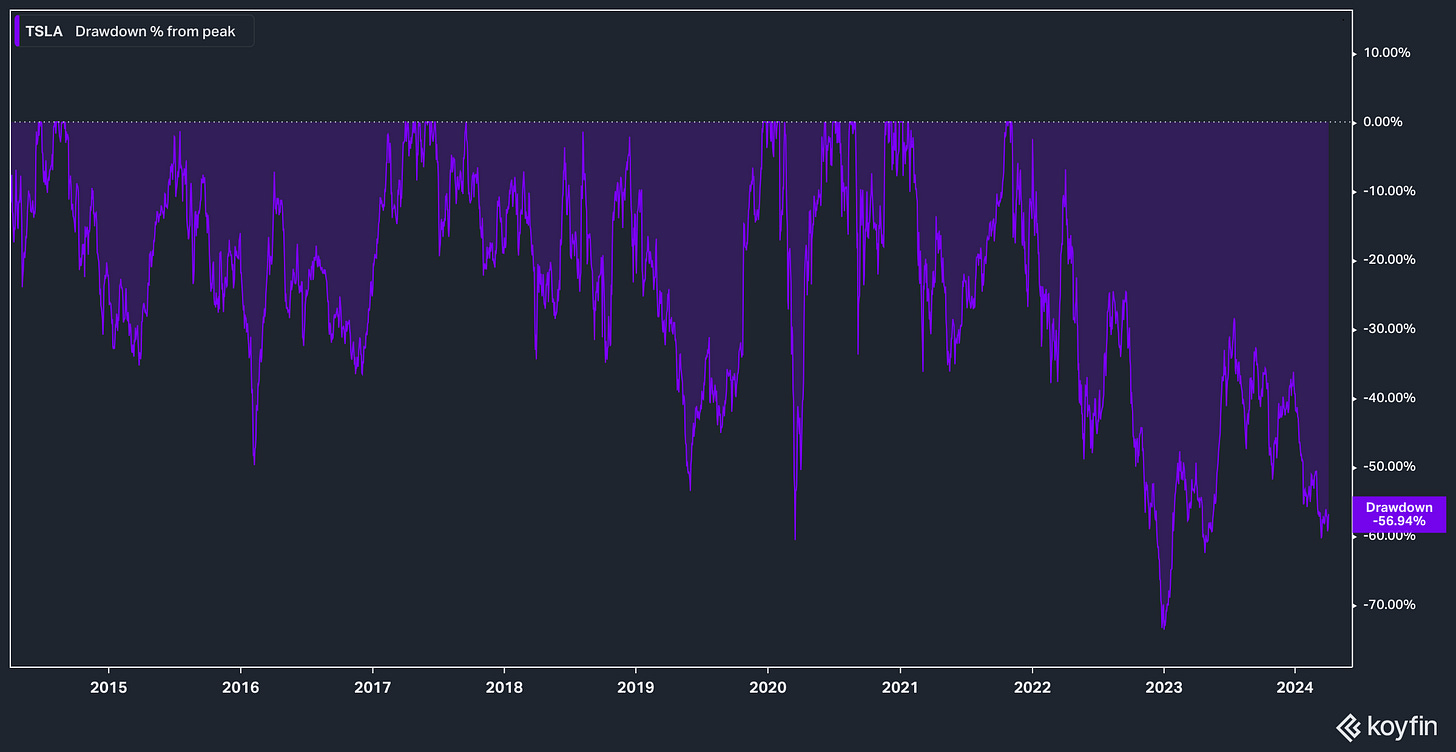

2024 hasn’t been kind to the EV maker. Year to date the stock has fallen ~28% and trades at half the price of its 2021 peak.

Of course, at these levels, the natural follow on argument is: the stock must be cheap!

Alas, it isn’t.

Even with these disappointing numbers, the stock is still almost twice as expensive as Microsoft and almost three times more expensive than Google on a forward P/E basis.

Given the fact that the company continues to lose market share to BYD in China, this does not appear, to me, like a buy-the-dip type situation.

Disclaimer: The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.