Texas Is Now California (At Least When It Comes To Housing)

The Lone Star State now suffers from the same affordability problems are California. PLUS: more pain for banks, and a cringe-inducing situation for Sam Bankman-Fried.

Thanks for reading today’s Market Beat! As always, please consider subscribing and/or sharing this with friends!

Don’t California My Texas

You know how some images or ideas just get seared into your brain, but you really don’t know why? Why, for example, this particular image, song, thought, et cetera, should occupy such a ready state of mental recall when it may be of so little consequence or overall importance?

Well, one of those things for me is an image and article from the Economist from waaaay back in 2009 (the headline photo of today’s Market Beat). The photo depicts a sad, fat, California style surfer, wandering out of the surf with his dilapidated board, while an energetic, buff Texan carrying a jet ski and wearing some obnoxious boots sprints to the water.

The article—again, published 15 years ago—outlined the seismic shift that was perceived to be happening between the two states:

AMERICA'S recent history has been a relentless tilt to the West—of people, ideas, commerce and even political power. California and Texas, the nation's two biggest states, are the twin poles of the West, but very different ones. For most of the 20th century the home of Silicon Valley and Hollywood has been the brainier, sexier, trendier of the two: its suburbs and freeways, its fads and foibles, its marvellous miscegenation have spread around the world. Texas, once a part of the Confederacy, has trailed behind: its cliché has been a conservative Christian in cowboy boots, much like a certain recent president. But twins can change places. Is that happening now?

Fast forward to today: a headline article in the Wall Street Journal writes about the current housing affordability crisis brewing in Texas that seems… oddly reminiscient of the never-ending housing affordability crisis in California.

Luis Torres, senior business economist at the Dallas Fed’s San Antonio branch, said that while Texas is still affordable compared with many other states, the drop in affordable housing was significant because the state was always less expensive than other parts of the U.S., and the region had never seen such sharp price increases. Home prices in Texas were largely flat from 2000 to 2005 when prices were rising nationally, which allowed Texas to largely escape the housing boom and subsequent bust that led to the 2007-09 recession.

Since the Economist article’s publication in 2009, the migration from California to Texas has ramped up significantly, with an estimated 80% increase in moves from 2012 to 2021, with an estimated 300 people per day making the inter-state move in the latter year.

Texas, of course, welcomed this inflow—the state has long-sought to attract business with its favorable tax laws and lower costs of living. Texas also knew that this inflow could have some unintended consequences, as the fiscal power of California’s exiting businesses combined with the more liberal tilt of the moving employees.

It would seem that, today, fifteen years later, some of those seeds of California-zation are beginning to sprout.

Courtroom Ex Drama

Most people dread the idea of running into their exes in public. Even if you don’t interact, the sight—the startled acknowledgement—can bring back waves of emotions. Not fun stuff, generally speaking.

Now, ratchet that feeling up about a billion times and imagine your ex testifying against you in a court of law.

Of course, that what Sam Bankman-Fried has had to endure as Caroline Ellison testifies against him. SBF isn’t exactly what you would call a sympathetic character, but man, I’m sure there are a lot of people out there who really wouldn’t want to be facing down what he is.

One of the big things to come out of this whole story is just how generally un-fun this group of folks were at FTX. Were they thieves? Seems like it, sure. But despite this, in their hearts, they were nerds. This wasn’t a frat-boy smash job, with wild parties and lavish yachts and houses (aside from the Bahamas penthouse where they all, in nerd fashion, communally crashed). No, this was just a bunch of nerds who never thought things would catch up to them.

Consider this piece from Bloomberg that recounted a bit of Ellison’s testimony:

Over nearly three hours, Ellison talked about Bankman-Fried through an intimate lens. The two met at Jane Street Capital and started dating on and off after she joined Alameda. She described Bankman-Fried as someone who was very interested in politics and wanted to use his money and influence. In private conversations, Bankman-Fried once told her that he calculated that he had a 5% chance of becoming the president of the US one day.

I’m sorry, but that is objectively hilarious and points to the sheer, pure, unvarnished nerdiness of this group.

Consider how most people talk to someone they’re trying to date. Typically, men will boast about future plans or dreams (no matter how ridiculous). It’s just part of the puffery that comes with dating. Now, imagine calculating the odds of becoming President, and showboating that statistic to impress a potential partner. Wild stuff.

More Pain For Banks

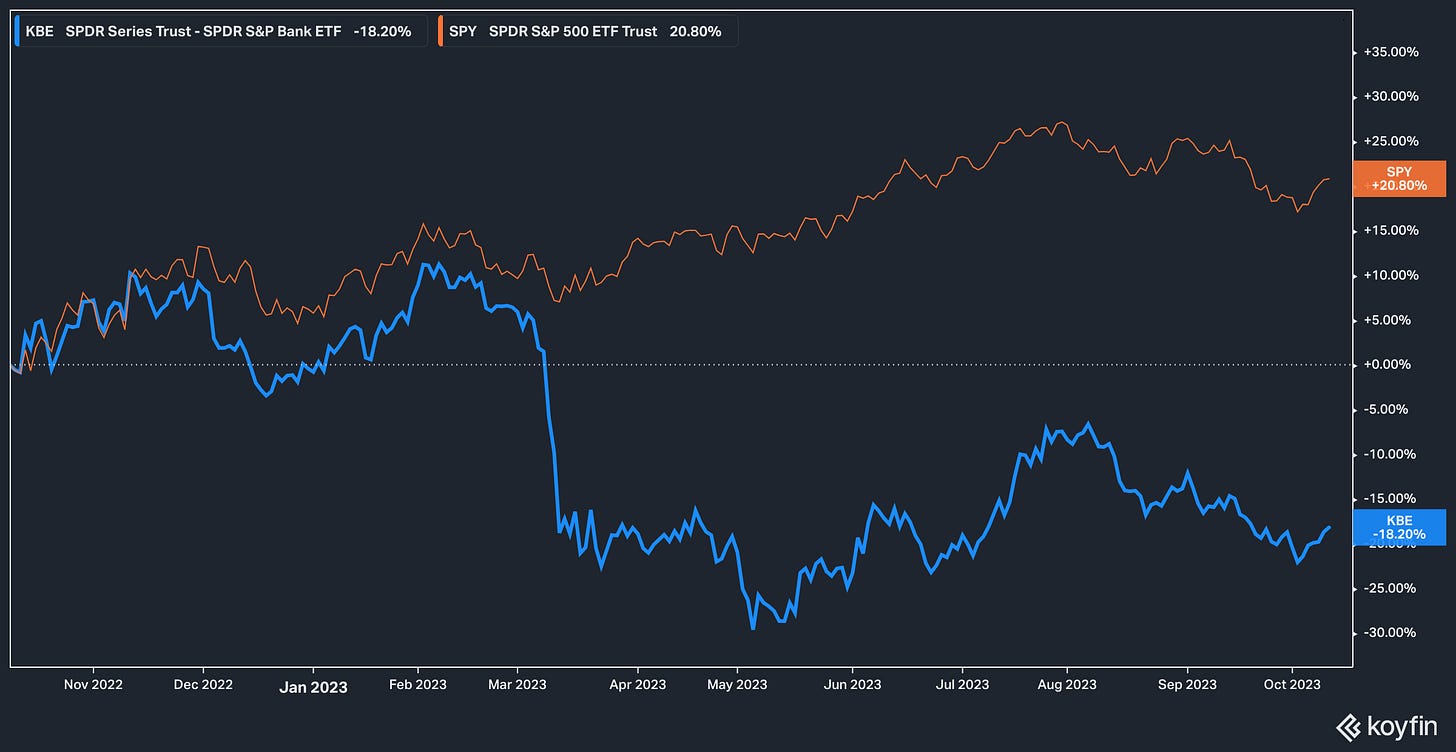

It’s a tough time to be a bank: generally speaking, high interest rates are good, but holding older, lower-yielding bonds on balance sheets is bad. An inability to pay competitive rates in savings accounts (as compared to, say, a money market fund) because of those old bonds is definitely bad.

Over the last year, banks have taken a collective shellacking. Still reeling from the hangover of the mini-banking crisis in early 2023, some analysts see further pain on the horizon in the form of onerous new regulations. The esteemed Jamie Dimon of J.P. Morgan probably summed up the anticipated outcome of stringent new regulation best when he said of the regulators themselves, “Do they ever want banks to be investable again?”

A recent Wall Street Journal article was, overall, pretty downbeat on the prospects for bank stocks, but did include a quote from one non-Debbie downer:

“From my standpoint, the stocks are pricing in permanent impairment of profitability, and I just don’t see that happening,” said David George, senior banking analyst at Baird. “Banks are not catalyst stocks; they’re risk-reward stocks.”

As I always say, the bargains are found in the places nobody wants to go. Today, bank stocks are that place. While the sector doesn’t seem to have a clear path out of the woods yet, I tend to side with Mr. David George in his sentiment that this pain won’t last forever.

Final Thoughts…

News that surprises no one: Uber’s Russian rival suspected of sharing data with Russian security services. Exxon’s buying spree continues. Watch out, DVA 0.00%↑, Ozempic may be coming for your business. Clever: Belgium to use tax revenues from frozen Russian assets to provide Ukrainian aid. It’s only 2023 and the roaring 20’s may be over. DIS 0.00%↑ is raising theme park prices again.