The Best Business You've (Probably) Never Heard Of

Exploring SSNC Technologies, a great business facing temporary headwinds.

Today, we cover a business that has seen its stock beaten down by a set of temporary headwinds despite high-quality recurring revenue and a sound underlying business.

The company is a leader in its space and has a reasonably defensible moat.

The market has devalued the shares to 10-year lows, but we think this is only temporary.

Background

There’s an old saying that in a gold rush, it’s better to sell pickaxes and shovels than it is to dig your own hole in the ground. The odds of success, as it were, are much more in your favor. With that in mind, there are plenty of examples across the investment universe where service providers have offered attractive returns to investors (consider: suppliers of industrial gases to manufacturers, or oilfield service companies).

The only problem with these types of businesses is that they tend to be steady and predictable. While that’s a good thing on its face, the market usually assigns a premium to these types of businesses which often makes the investment somewhat unattractive.

Once in a blue moon, however, one of these businesses goes on sale. Today we present SS&C Technology Holdings, Inc SSNC 0.00%↑, a provider of front, mid, and back office software to hedge funds, mutual funds, and other financial institutions. The company also has an arm that provides backend software solutions for the healthcare industry.

The company describes its business this way in its latest 10K:

SS&C Technologies Holdings, Inc. (NASDAQ: SSNC) is the world’s largest hedge fund and private equity administrator, as well as the largest mutual fund transfer agent. SS&C’s unique business model combines end-to-end expertise across financial services operations with software and solutions to service even the most demanding customers in the financial services and healthcare industries. SS&C owns and operates the full technology stack across securities accounting, front-to-back-office operations, performance and risk analytics, regulatory reporting and healthcare information processes.

Contracts between SS&C and customers typically range between 1-5 years. Implementation of this kind of software is exceptionally time-consuming and expensive for customers, which is the first layer of SS&C’s competitive moat. Customer retention, then, is a key metric for the company, and on this front SS&C does quite well. Speaking at the UBS Global Technology Conference just this past week, CEO William Stone has this to say in response to an audience question regarding retention:

We have a high customer satisfaction percentage, and we run our retention rates above where they were last quarter, which was the highest in our history. Or close to the highest in our history at 97.3%. So we'd like to run it 98%, 99%.

So, to recap in very broad strokes, we have a business where:

Revenue is high-quality and recurring.

Customer retention levels are high.

The product has relatively high switching costs for customers.

This isn’t exactly the kind of business one would expect to find underperforming in the stock market, and yet it has.

In the last three years, SS&C has delivered -16% on a total return basis (almost -20% on a price change basis).

The natural next thought, then, is that the underlying trends in the business are corroding—perhaps the outlook has shifted unfavorably?

But that doesn’t seem to be the case.

Starting in January 2022, SS&C’s stock began to fall. In mid-2022, forward EBIT estimates began to move downward as well, punishing the stock further. Recently, however, EBIT estimates have recovered while the stock still trades in a doldrum range between $50-60.

Virtually every forward valuation metric for the company is in the bottom quartile (or decile) when compared to a 10-year range.

Honing in on forward earnings and EV/EBITDA valuations paints an even starker picture.

Today SS&C changes hands at 11.2X forward earnings and 9.2x forward EV/EBITDA, well below the 10-year averages of 16.8x and 12.5x, respectively.

So, What Gives?

It’s not normal for the market to mark down a high-quality business for no reason, so the next obvious question is: Why? Why does this stock trade so cheaply against historic valuations?

The reason, we think, has a lot to do with interest rates.

While organic growth at SS&C isn’t non-existent, it also isn’t overwhelmingly impressive. As Stone remarked in the latest earnings call, “third quarter adjusted organic revenue was up 2.3%”, which was a disappointment for analysts (though the miss was only $13 million on average estimated top line revenue of $1.38 billion).

Acquisitions, then, are an important part of revenue growth for the company. Higher costs of capital associated with higher interest rates along with an inflated equity market overall means that good deals are hard to come by.

Management has been vocal about their reluctance to overpay for assets. Stone made the following remark on the latest earnings call in response to a question regarding M&A prospects:

I would say that our acquisition strategy hasn't changed. We're methodically opportunistic, right? What has changed is the interest rate environment. and then sellers are still have illusions of [indiscernible], of what their assets are worth. So you're careful about not overpaying for an asset, you are using leverage.

The rate environment does indeed seem to have had an impact on SS&C stock. Consider the relationship between the company’s forward earnings valuation against the U.S. Treasury 10-year yield.

Since rates began rising in 2022, a very clear relationship has emerged between SS&C’s valuation and 10-year yields, in particular. This makes sense—if not only a company’s prospects for growth have grown more expensive, but the cost of acquiring those prospects has gone up as well, then, well, it seems somewhat logical that the market would punish the stock no matter the long-term prospect for the company.

What’s Baked In

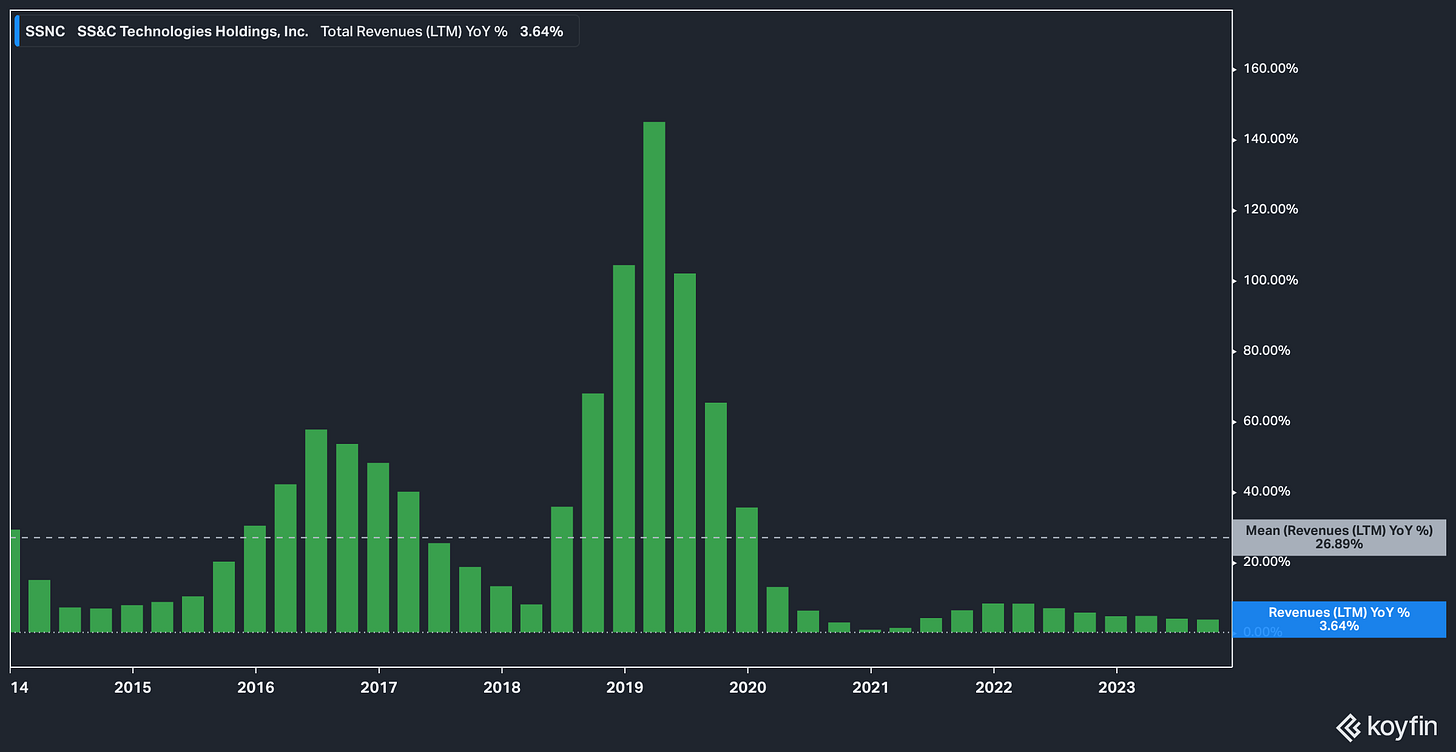

We ran a reverse DCF model on SS&C to gauge what sort of expectations the market may be currently pricing into the stock.1 Largely due to the acquisitive nature of its business, SS&C has had lumpy year-over-year revenue growth rates.

Today the company is posting the lowest growth rates of the last ten years, principally due to an unattractive M&A market as previously discussed.

With the stock trading at $56 and estimating an 8% WACC, we think the market has priced in roughly 1% revenue growth at the company over the next five years.

While it’s true that the company’s growth has slowed, we think that the pessimism has been overdone.

Consider where the market is currently predicting rates to be at for the Fed’s May 2024 meeting:

The market is actively moving expectations for rates down, pricing in only a 20% chance that rates will remain in the current 5.25%-5.50% range.

As mentioned before, we think that any downward move in rates will be a tailwind for SS&C.

Targets

Given historic valuations and targeting a just-below analyst consensus FY2025 earnings for our base case at $5.70 adjusted EPS, we think a fair target for SS&C would be $79.

Our base case assumes that the stock will not return to its 10-year average P/E of 16.8x as interest rates are not (in our opinion) as likely to revisit historic lows as they are simply to come down. Our bear case implies rates remaining much higher for longer and SS&C’s P/E subsequently not re-rating from today’s levels.

Disclaimer: The information contained herein is opinion and for informational and entertainment purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

For those unfamiliar with reverse DCFs, they are useful but are a very, very blunt tool and heavily reliant on assumptions.

I wish I had never heard of the business!

I am guessing you have never had the displeasure of being a customer of theirs on the fund side or the investor side? Worst fund admin I have ever had the misfortune of experiencing. Poor tech, poor customer service, perpetually changing staff roster. I hope others have had a better experience, although nobody that I know who has used them has.

Not a comment on the trade. More a personal musing on their business fraying.

Share price is $56 and EPS is $2.50, so a p/e of 22?