Thanks for checking out the latest equity deep dive from Ironside Research! If you enjoy our work, please be sure to subscribe to receive updates when we publish new research. Also be sure to check out our disclaimer below. Cheers!

Highlights

Carriage Services is a cemetery and funeral operator

The company’s stock has been punished following a failed takeover attempt by a rival as well as a heavy load of debt

We make the case for why we think the stock has been overly punished and could re-rate in the future

Certainties

As the old saying goes, death and taxes are the only sure things in life. To take a slightly different, perhaps morbid, angle on that saying, death and taxes are very, very good business to be in.

Carriage Services Inc CSV 0.00%↑ is a leading nationwide provider of funeral and cemetery services, a business line which is notoriously fractured and dominated by small, independent operators.

In the last five years, Carriage Services has had quite the rise and fall, peaking at more than 300% on a total return basis at the end of 2021 before giving most of the gains back and eventually underperforming the S&P 500 SPY 0.00%↑ over a five year time frame.

We think, however, that the stock’s worst days are behind it and that it could have 50% upside from current levels. Let’s dive in.

The Landscape & A Failed Takeover

Three major players dominate the funeral and cemetery services business in North America—Service Corporation International SCI 0.00%↑ is the largest with a more than $8 billion market capitalization. Carriage Services comes in second while Park Lawn Corporation PLC 0.00%↑ (which trades on the TSX) sits in third place. This oligopoly has very little competition to speak of, and growth is driven primarily by acquisition of smaller, independent players.

On June 29th 2023, Carriage announced that the board was seeking ‘strategic alternatives’ which could include a potential sale. Park Lawn was revealed as the potential bidder and offered $34 per share for the company (Carriage closed at $27.80 the day before the announcement).

Things then went south. On October 2nd, Park Lawn announced that it no longer intended to pursue the acquisition, and the stock fell hard on the news and has continued to grind downward, dropping by 20% since the news broke.

What seems to have gone unnoticed by the broader market, however, was an announcement made by Carriage’s board on October 4th that “Carriage’s Board of Directors continues its process to review strategic alternatives to maximize shareholder value.”

Of course, saying you’re looking for a buyer in this industry is a bit like going to a dance with three people—if one doesn’t want to dance with you, you’d better damn well hope the other one isn’t as picky.

In other words, the only true possibility that we can see for Carriage going forward in terms of a sale would be to Service Corporation.

How likely could this be?

Well, based on the 14.3 million shares outstanding, we ballpark Park Lawn’s offer for Carriage at $525 million—which seems good against Carriage’s (current) market capitalization of roughly $330 million, but bad against the company’s enterprise value of $911 million (the company carries a lot of debt, more on that later).

While we can’t know for sure, we think it could be reasonably understood that the offer from Park Lawn simply wasn’t sufficient for Carriage’s board (a buyout of the company at enterprise value would require a roughly $61 per share offer).

Based on Service Corporation’s history, however, it doesn’t seem like they’d be willing to pony up that kind of dough, though if they did it wouldn’t be without precedent. Service has gobbled up larger competitors in the past, including Stewart in 2013 (then the second-largest provider of deathcare services) and a majority stake The Neptune Society (the largest cremator in the country) in 2011. Aside from that, large-scale acquisitions have not seemed to factor heavily into Service’s strategy.

Spiking interest rates are likely to put a further dampener on Service’s ambitions (whatever they may be), and likely to bode ill for investors holding out that Service will swoop in an acquire Carriage.1

Thus, we believe the market is pricing this negativity in. We would sum the prevailing sentiment against Carriage as:

Park Lawn didn’t want to or couldn’t buy this, the company is laden with debt, and the only other potential buyer isn’t likely to come near it with a ten-foot pole in this macro environment.

This negativity, we think, has gone a bit overboard.

Debt, Debt, Debt

It is true that Carriage has a lot of debt ($609 million in net debt), but there are a few things to consider about the industry before wiping your hands of the company.

First, the only real viable option for growth in this space is acquisition. Organic growth would require the death rate to rise (not ideal), and since the deathcare industry is ubiquitous there are no (or very, very few) truly under-served geographies. Additionally, the cost of funding acquisitions has been quite cheap. As a result, the large players in the deathcare space carry high amounts of debt.

Carriage carries more debt than its peers (its net debt/EBITDA of 5.8x vs. Service Corporation’s 3.5x), but we think a few things differentiate debt in this industry from most others, namely: the quality of the cash flows in the industry are about as good as it gets. The unfortunate reality is that as long as people continue to be born, they will die—there is no consumer choice.

The lion’s share of Carriage’s debt is also long-term and fixed-rate—it’s roughly $400 million in senior notes are 4.25% and mature in 2029.

The remaining bit of $187 million of debt is the tricky part—it is variable and came from the company’s credit facility. Management is aware of the problem and working to pay down debt (the company paid down $16.7 million in Q3, but this is likely to be cold comfort to investors who watched interest expense on the debt balloon from $1.9 million in Q3 22 to $4.5 million in Q3 of this year. As CEO Carlos Quezada noted in response to an analyst question in the most recent earnings call “[W]ith the debt that we have, as you know, it does make a significant impact in our financial performance.”

However, the variable debt is doing a lot of work, we think, to sour investors on Carriage—work that is maybe getting a bit too much credit. Backing out the variable debt results in the net debt/EBITDA of 3.9x (much more tolerable), and management committed multiple times on the latest earnings call that paying down the variable debt was a top priority. As CFO Kian Granmayeh stated “we will continue to be laser-focused on capital allocation and paying down the variable interest debt.”

At the end of the day, we think that:

Carriage makes money, and the demand side of the business isn’t going anywhere

It has the ability to pay off its debt

As interest rates level out (and, presumably, fall at some point in the future) the burden on Carriage will subsequently lessen

Valuation

Over the last 20 years, Carriage has averaged a forward P/E of 13.8x and an EV/EBITDA of 8.8x (10-year average is 14.1x and 9.6x, respectively). Today the stock trades hands at 9.4x forward earnings and 8.6x EV/EBITDA.

Judging by where valuations have gravitated over a long time horizon can help inform our opinion about whether a stock has fundamentally re-rated, or whether we think it more likely that the market is out ahead of its skis.

Another factor pushing us towards ‘the market is overreacting camp’ is the relationship between Carriage’s stock price and its forward EBIT estimates. Prior to Covid, the stock traded mainly in line with EBIT estimates. Covid created a bit of a dislocation as estimates continued to jump and the stock raced higher. The rising interest rate environment of 2022 onward, however, has created a unique situation—EBIT estimates have recovered, but the stock has been continually pressured downwards.

We think this is a testament to how rate-sensitive debt-laden companies like Carriage are, but we also think there are limits to what is reasonable here. Again, demand clearly hasn’t evaporated, and the company’s debt position is not terminal.

The Bottom Line

With today’s P/E plumbing depths not seen since the flash-recession of 2020 and the time trailing the GFC before that, we are inclined to think that a) debt, and b) bad news with the failed acquisition have sent this stock to the doldrums despite a business outlook that hasn’t changed.

Oh, and to top things off, the company is an active cannibal of its own shares. In the last five years the company has repurchased almost 22% of outstanding shares (yellow in the chart below).

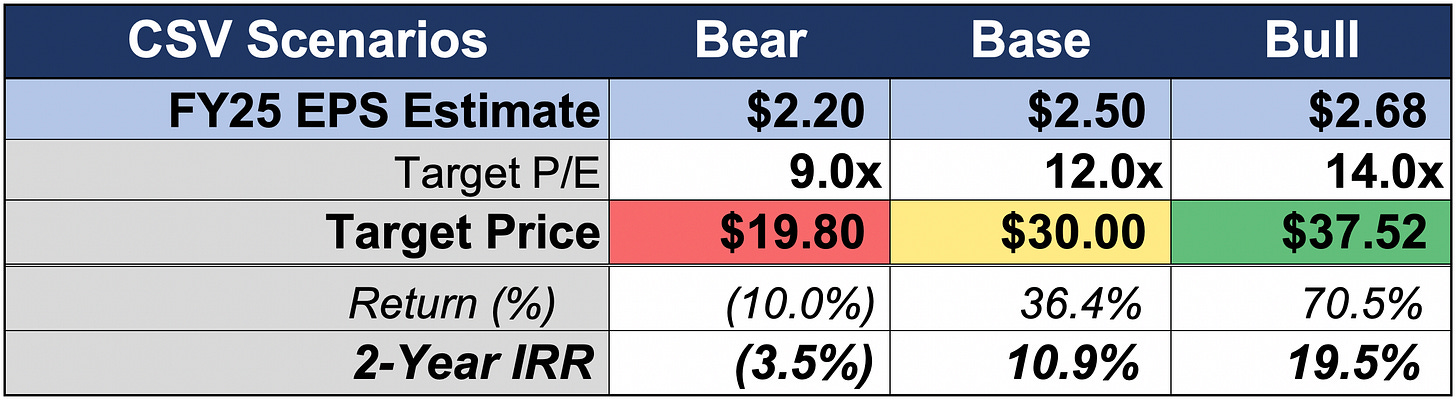

For these reasons we set our base case P/E for 2025 earnings at 12x, our bull case at 14x (the ten year average), and our bear case at 9x.

We would like to note that our base case EPS is lower than the current consensus FY25 EPS (which, full disclosure, appears to be comprised on only one analyst looking that far out) of $2.68 per share, which we have made our bull case. Should management deliver, interest rates fall, and the stock re-rate back into a normal range, we do not believe that the bull case could be achieved.

Further, we also cannot rule out the possibility of a buyout. The deathcare space has been in consolidation mode for decades, and while Service Corporation has not executed a large deal for several years, it is not entirely out of the realm of possibility that they could swoop in and acquire Carriage at a premium to today’s price.

Disclaimer: The information contained herein is opinion and for informational and entertainment purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Of course, it goes without saying that they could just as well make an offer.

Nice Find!

yeah it's undervalued and I like the buyback activity. keep up the research.